How to buy a house at auction

Buying at auction can mean you secure your dream property for a bargain price, but preparation is the key

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Tempted to skip a private treaty sale and buy a property at auction instead? From flats and terraced houses, through to cottages and mansions, auctions can be a rich hunting ground.

‘Auctions offer opportunities you simply won’t find on the open market,’ explains Andrew Binstock, from Auction House London. ‘Whether it’s an investment property with tenants in situ, a refurbishment project or a well-located home priced to sell.’

And if you thought auctions are dominated by properties in need of TLC, then think again, suggests Richard Adamson, managing partner and residential auctioneer at Allsop. ‘Don’t assume that all auction properties are distressed or repossessed; a wide range of properties are sold at auction,’ he says.

In fact, now could be the perfect time to take the plunge. Scott Hendry, director of auction finance at property lender Together, reckons ‘the buyer’s market means that now may be the best time to make a move on the low prices available’.

"We have tons of people who come to the auction looking for a project... They want to come to auction and complete a month later, and be ready to get cracking"

It certainly seems that more buyers are getting in on the act. According to Auction House’s national commercial director, Oliver Prior, its weekly national online auction ‘has gone from strength-to-strength this year’. It hosted its biggest ever weekly national online auction in August, with 96 lots going under the gavel.

Andrew too reports that demand for realistically-priced property remains ‘as strong as ever’. ‘Rising mortgage rates and uncertainty in the market have meant more people are turning to auctions as a quicker, more transparent way of buying and selling,’ he says.

Despite an increase in build costs, appetite for ‘doer-uppers’ is huge, says Ian Kitson, director at Cheffins.

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

‘We have tons of people who come to the auction looking for a project. They often don’t want to go through the hassle of a private treaty purchase. They want to come to auction and complete a month later, and be ready to get cracking,’ he explains.

‘These vary from property developer types to also private buyers. And we have seen an increase in younger private buyers being willing to take on a doer-upper as they struggle with house prices and affordability locally.’

Still, if you plan to buy a property at auction, you need to have your wits about you. Here’s all you need to know about the world of auctions.

What is the process of buying a house at auction?

These days, there are two auction formats.

The traditional method of auction is arguably the most well-known, with the auction taking place at a set date, time and place.

If the gavel falls and you’re the successful bidder, the purchase becomes legally binding straight away. You need to pay a deposit of typically 10% and exchange contracts that day. You normally have up to 28 days to complete the purchase.

The modern method of auction offers a longer timescale in which to transact. The auction takes place online, with buyers typically able to bid over the course of several days or weeks, right up until the cut-off point.

If you’re the successful bidder, you fork out a reservation fee of at least 3% to secure the property on an exclusive basis. You then usually have 28 days to exchange contracts, and another 28 days to complete.

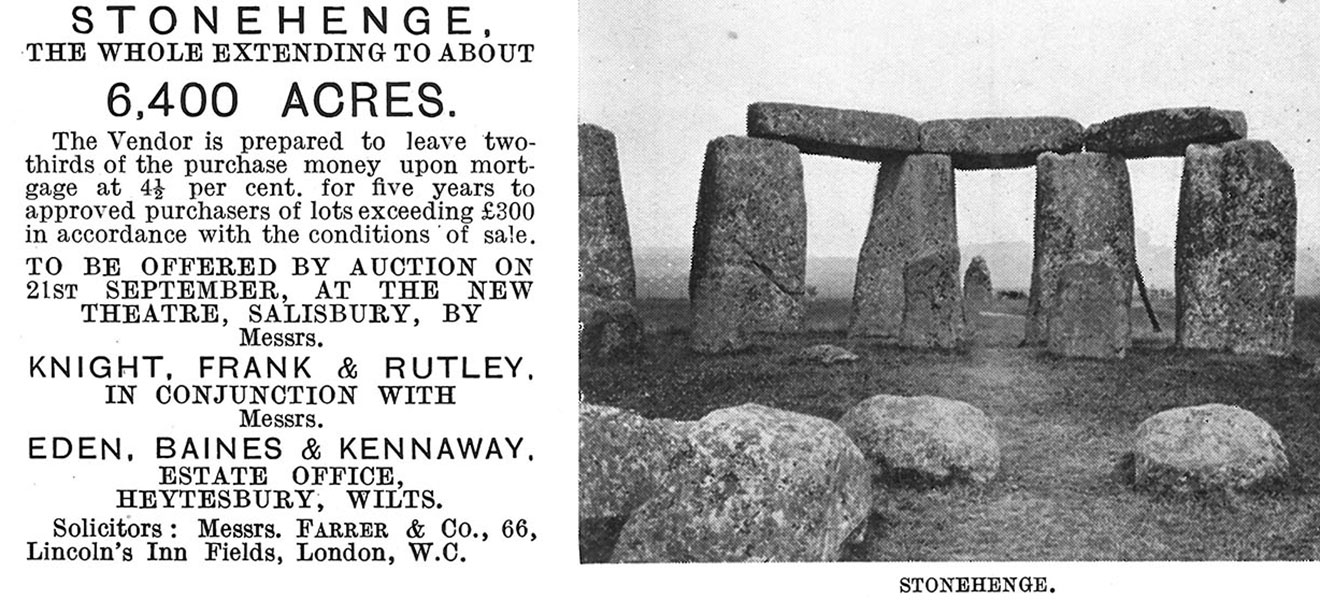

The ultimate property auction? Stonehenge was sold in an auction following this 1915 advert in Country Life.

What to do before buying a house at auction

There’s a lot of preparation involved before you even consider bidding. And there's often only a small window in which to do it, with catalogues normally issued a few weeks before auction.

Peter Mayo, auctioneer and partner at Knight Frank, says: ‘Having attended auctions for the last 40 years, “Preparation — be prepared” is the best advice I can give to potential bidders.’

Here are five steps to get ahead:

1. Register your details

Sign up with property auction houses that operate in the area you want to buy. Make sure you’re added to their mailing list so that you can get your hands on their catalogues as soon as possible.

2. Line up professionals

Have reputable professionals on hand to advise you. A conveyancer or solicitor to sift through the legal paperwork is key. If you’re planning to buy with finance, it could well be worth getting a mortgage broker onboard. Some mortgages will be better suited to your needs than others. You may also like to hire a surveyor.

Ian advises: ‘If you plan to instruct a surveyor to inspect the property and a solicitor to look through the legal pack, do so in good time, to allow them sufficient time to get back to you.’

Other professionals you may want on speed dial include a planner or architect and a builder.

Richard warns: ‘Don’t skip professional advice in an attempt to save money, as this may lead to costly problems later.’

3. Get to grips with the property

Once you’ve found a property you’re interested in, do your homework. Speak with the auctioneer to glean as much intel as you can about the property — and arrange to view it. Consider having a survey done to suss out what state it’s in.

Chat with neighbours and local estate agents too about the property, the area, and the housing market. They may have some useful nuggets of information.

If you’re planning to renovate the property, ask a surveyor, planner or architect, and/or builder for advice. They can give you a steer on what might be possible and the likely costs and risks involved.

Ian says the key for buyers eyeing a renovation project is ‘to know your skills and what levels of work you are willing to undertake and pick your property appropriately’.

Know what you're getting in to: Ribbesford House was auctioned in 2018 with a £500,000 guide price, with property developer Sam Leeds eventually buying it for £800,000. Many repairs have been done, but as of the summer of 2025 he is yet to get planning permission for the work he wishes to do — but he's been able to hold on to the property in the mean time.

In Richard’s view, if you’re buying a listed property, ‘it is essential to get a thorough understanding of the opportunities and limitations that come with it’.

‘Depending on its grading, certain types of alterations may not be possible or would require listed building consent,’ he explains. ‘Buyers need to be prepared to pay a premium on any required alterations. Refurbishing a listed building comes at a higher cost.’

4. Arrange your finances

Get your funds in place. If you’re buying with cash, have it waiting in the wings. And if you’re buying with a mortgage, Peter advises getting confirmation from your lender that they are happy to lend against the property.

‘Make sure that you are able to keep to the auction timescale,’ adds Ian. ‘You must therefore ensure that you have arranged any finance, if needed, in good time, and that your lender can also keep to these timescales.’

5. Read the small print

A pack of legal documents and other important information, such as title deeds, local searches, and conditions of sale, is available for properties before auction. Make sure a solicitor or conveyancer goes through this with a fine-tooth comb.

‘Don’t bid without fully understanding the legal and financial commitments involved in the purchase,’ warns Richard.

What happens on auction day?

If you’re planning to bid in a traditional auction, arrive at the auction in good time. Remember to bring supporting documents, such as photo ID and proof of residence, so that if you’re the winning bidder, you can proceed with the transaction.

Sit in a visible spot at the back of the auction room. That way, you have a good view of what other bidders are up to and the auctioneer can clearly see you.

Keep an ear to the ground for any last-minute changes.

And when you bid, make sure it’s clear and that it's acknowledged by the auctioneer.

If your bid is the winning one, there’ll be a flurry of activity as you pay the deposit and exchange contracts.

Tips and tricks for buying a house at auction

Observe auctions first

Attend some auctions before you bid to understand how they work and get used to the jargon. You’ll need to know the difference between a reserve price and a guide price, for example.

Richard suggests ‘attending a few, either online or in person, to get a feel for the process and atmosphere’

Clear your diary

Catalogues are normally issued just a few weeks before the auction, so allow enough time to do your due diligence

Keep in touch with the auctioneer

Make sure your finger is on the pulse in the lead up to the auction. Some properties may be sold or withdrawn before the auction, while others may be added. There could also be amendments, such as price changes. ‘Do let the auctioneers know you are interested, they are there to help,’ says Peter

Consider making a pre-auction offer

Some sellers may be open to agreeing a sale before auction day. ‘Remember that although most properties are sold on the day of auction, some are sold before or after the sale,’ says Ian. ‘If you are very interested in a property, it is often beneficial to make the auctioneer aware of your interest and ask them to keep you informed if a pre-auction sale looks likely’

Set a price limit

Decide on your maximum price before the auction to avoid paying more than you can afford in the heat of the moment.

‘At auction, as is ever the case, do your budgeting before you bid, work out your costs and your margins and allow for a buffer for overrunning costs,’ says Ian. ‘Buyers need to be content that whatever their maximum bid is right for them, and to not let competitive nature take over on auction day.’

For Sam Butler, senior partner at Butler Sherborn, it’s important to attend an auction prepared for all eventualities. ‘Sometimes buyers can pick up a deal whilst on other occasions competition in the room may push up the price,’ he points out

Keep cool-headed

Auctions can be, among other things, thrilling and nerve wracking so try to keep your emotions in check. ‘Discipline wins over impulse,’ advises Andrew.

Peter agrees: ‘Of course, on the day of the auction, nerves are to be expected but if you are still unsure then do not bid. There will always be another property, another auction!’

If you’re unsuccessful, consider an unsold lot

Ask the auctioneer about properties that have been withdrawn — the sellers may be keen to strike a deal. Some properties, for example, don’t receive any bids or fail to fetch the reserve price (the minimum the seller is willing to accept). Just make sure you find out why they didn’t sell in the first place

This house in Windsor — where Anne Boleyn used to meet Henry VIII while they were still just lovers — came up for auction in August 2025.

Buying a house at auction: Frequently asked questions

Is it worth buying a property at auction?

There are pros and cons to buying a property at auction. On the plus side, ‘bidding at auction provides transparency, can be very exciting and provide certainty!’ says Sam.

This chimes with Andrew Binstock, who says the three big advantages are speed, certainty, and opportunity.

‘Once the hammer falls and an agreement is in place, contracts are exchanged — so you avoid the long chains and fall-throughs that often happen in the open market with a 28-day completion period,’ Andrew explains.

‘Auctions also offer opportunities you won’t always find on the high street, from quirky renovation projects to unique homes and competitively-priced properties.’

He adds that a big perk is transparency: ‘You can see exactly what someone else is bidding and when.’

But there are potential disadvantages to buying a property at auction too. These include the tight timeframe in which to get your ducks in a row. There’s the risk of getting carried away in the heat of the moment at auction too. Also bear in mind that if you're successful in a traditional auction, you’re locked into the purchase as soon as the gavel falls, so there’s no going back.

Do you need a solicitor to buy a house at auction?

If you’re the successful bidder, you’re tied in on a conditional or unconditional basis (depending on the auction method). So, it’s well worth having a legal eye to study the paperwork before you bid. As Richard points out, ‘a solicitor can help you identify any potential issues in the legal pack that could affect your purchase’.

Do you need cash to buy at auction?

No, you don’t need to be a cash buyer to bid for a property at auction. That said, you do need funds readily available. Depending on the auction method, you must put down a reserve fee or deposit on auction day — and fork out the remaining sale price soon after.