Property Talk: How the Autumn Statement tiptoed delicately around the property market

Chancellor of the Exchequer Jeremy Hunt seems to have tried to avoid rocking an already teetering property market. Annabel Dixon takes a look at what the Autumn Statement means for the property market.

And so, the hotly-anticipated Autumn Statement has been unveiled.

The Chancellor, Jeremy Hunt, had already set the scene. Last month, he warned MPs of decisions of ‘eye-watering difficulty’, naturally catching the news headlines. As he settled into Number 11 Downing Street, he delayed the announcement of his economic plans (originally set for Halloween). And the opening line of the Chancellor’s Autumn Statement this week referred to ‘unprecedented global headwinds’.

So what did Hunt have up his sleeve for the housing market? ‘On the face of it, the Chancellor appears to have done very little to compromise the property market and number of transactions, which is good news,’ says Jeremy Leaf, north London estate agent and a former RICS residential chairman.

The Chancellor has clearly made the decision not to meddle in the housing market. As we reported recently in our article on what's next for house prices, falls of 5% to 15% are widely expected; and this morning, the Office for Budget Responsibility released their projection of an estimated 9% fall in prices in the next two years. The government might be leaving things alone, and that seems sensible considering that downward pressure on house prices that is already in place. ‘There will be less money in people’s pockets when it comes to buying property and worries about rising interest rates,’ adds Jeremy Leaf.

With media speculation swirling recently about what would feature in the Autumn Statement, the cut to the capital gains tax (CGT) exemption did not come as a great surprise to market watchers. The move means that in the housing market, the likes of landlords and second home owners are set to pay higher tax bills when they come to sell property.

The cut is a further disincentive for landlords, who may already be reassessing their portfolios as house prices begin to drop. But, like other announcements in the Autumn Statement, it could have been worse, says Tom Bill, head of UK residential research at Knight Frank. He adds: ‘It will disproportionately affect landlords of lower-value properties but CGT rates have not been aligned with income tax, so a material drop in demand or a wave of selling is unlikely.’

It’s the latest in a string of changes to impact the sector recently, with thousands of landlords exiting the buy-to-let market this year alone, according to the Daily Telegraph.

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

Another Autumn Statement headline-grabber for the housing market was the Chancellor’s decision to put a time limit on his predecessor’s Stamp Duty cut. After March 2025, Hunt will, to use his intriguing phrase, ‘sunset the measure’. He has, in effect, turned a Kwasi Kwarteng Stamp Duty cut into an extended Stamp Duty holiday.

Of course, this measure was kicked so far down the road by Hunt (namely two months after the latest possible date of the next General Election) that it's fairly pointless worrying about it right now. The last few years have proven that we've scarcely any idea what the economic outlook will be in three months' time, let alone 30 months.

In any case, its impact is fairly limited taking into account the bigger picture. The savings this time around are lower than those available during the 2020-21 Stamp Duty holiday announced in the early months of the Pandemic which Rishi Sunak was still chancellor, and Rightmove property expert, Tim Bannister thinks it'll barely make a ripple amid an economic situation that's wildly different. ‘We don’t foresee the removal having a significantly dampening effect in 2025, with factors such as mortgage rates and house prices likely to have a much bigger impact on activity levels,’ he explains.

For now, as the dust settles, it’s time to do the sums to find out exactly how the Autumn Statement’s measures will impact us.

Credit: Alamy

Property Talk: What the Bank of England's interest rate rise means for the property market

The worst-kept secret in the world of finance was revealed on Thursday as the Bank of England raised interest rates

Credit: Ian Georgeson / Alamy Stock Photo

Property Talk: 1980s nostalgia is great... but not when it's about the property market

A dose of 1980s cultural nostalgia is always welcome, but economic nostalgia? No thanks. Inflation and interest rates are heading

Property talk: 'Developments are beginning to be reflected in data... We are seeing a slowdown'

The latest news from the property market strongly suggests house prices have now tailed off — but where do they go

Credit: Getty Images

What's next for house prices? Loss of momentum, discounts — and it's only just begun

Six months on from Liz Truss's disastrous stint as prime minister, the fallout is still being felt in the property

Property Talk: Will the 'storm clouds' in the property market be blown away by a new resident at 11 Downing Street?

A downbeat prognosis from the nation's chartered surveyors, a new Chancellor of the Exchequer, and a government walking back several

'A soft landing is still possible for the housing market'... but is it likely?

The latest data all point in one direction for house prices, but will we see a cliff-edge drop as we've

-

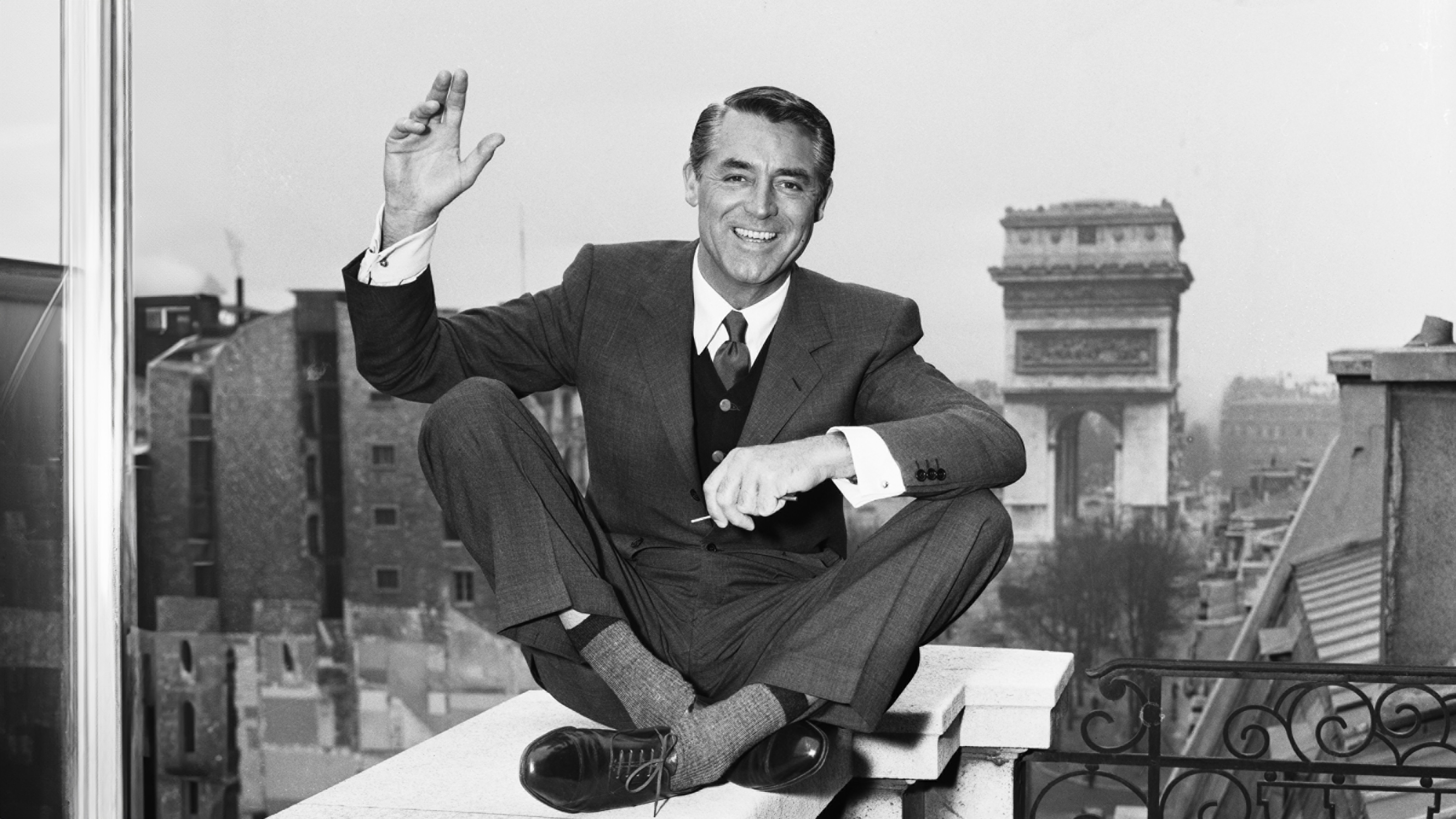

Suit yourself: I’m a 49 year-old man-about-town and I’ve never owned a suit

Suit yourself: I’m a 49 year-old man-about-town and I’ve never owned a suitWhen Hugh Smithson-Wright turned up to Country Life's annual Gentleman's Life party sans suit, it sparked a passionate conversation about why the formal fashion just isn't for everyone.

By Hugh Smithson-Wright Published

-

'The ugliness and craziness is a part of its charm': The Country Life guide to Bangkok

'The ugliness and craziness is a part of its charm': The Country Life guide to BangkokWhere to stay, where to eat and what to do in the Thai capital.

By Luke Abrahams Published