What you need to know about house insurance while you're renovating your property

If you're having work done to your house, it's important to be prepared in the event that things go wrong. A specialist renovation insurance policy can protect you from financial loss, explains Hugo Johnsen FCII, director at Castleacre Insurance.

What should you consider when you begin a renovation project?

Embarking on a new project can be hugely exciting, especially when you have found the right contractor and project manager. There are real benefits to using architects and contractors who understand historic buildings, the sensitivity required to maintain their character and the costs of employing skilled craftspeople and specialist building materials.

If your property is a listed building, a protected structure or it stands within a conservation area, you must have the right permissions in place, unless you are simply replacing or repairing with identical materials and design — what is known as ‘like for like’ repair. If you carry out work that requires consent and you don’t have it, you can face fines, criminal prosecution and be forced to reinstate the original building.

Do you need to tell your insurer about your renovation project?

Whatever the scale of your project, you should ascertain what is included in your existing insurance. Insurers will generally allow for a certain level of work without needing you to inform them, but once the value exceeds their limit (which varies enormously across insurers), you must let them know or your cover could be invalidated.

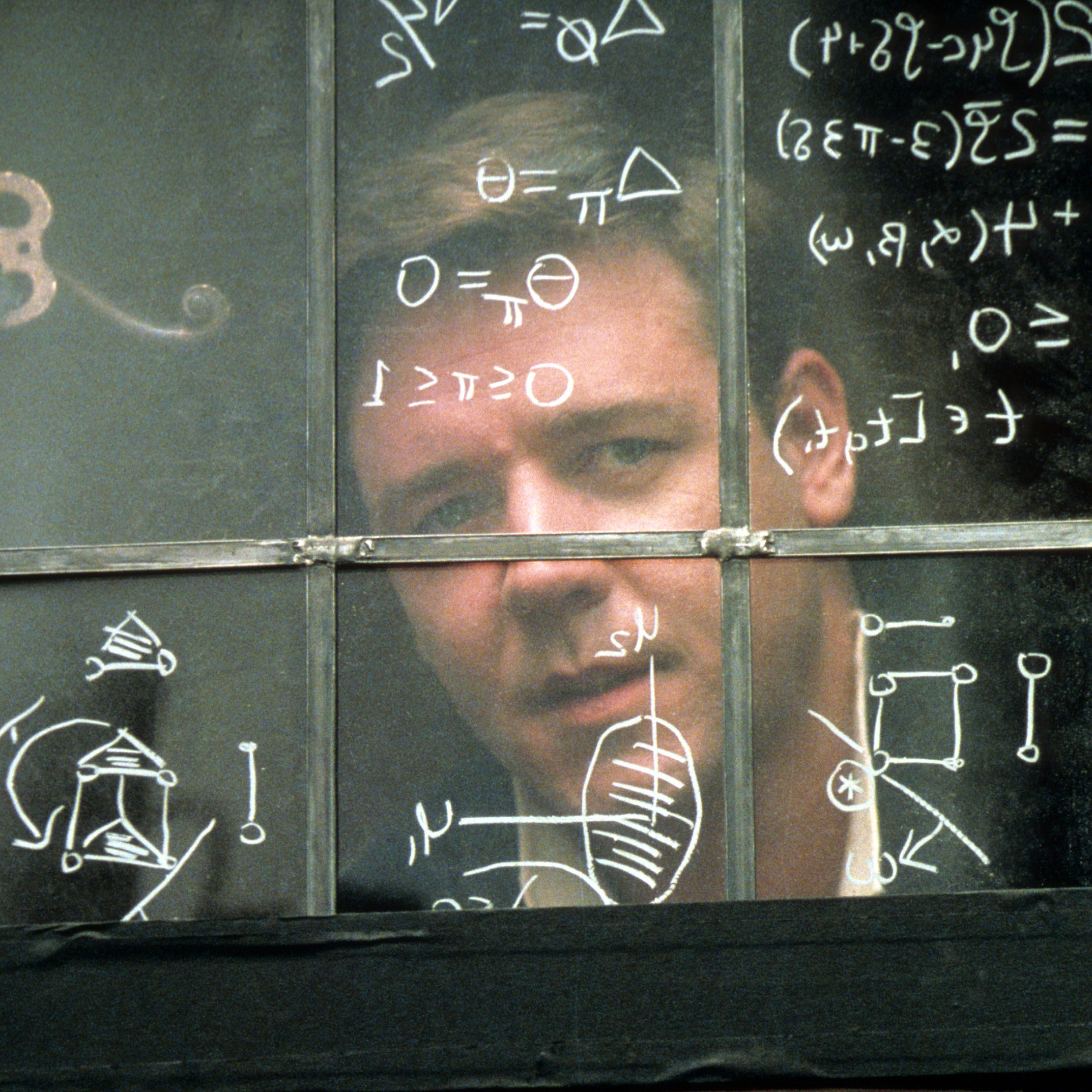

The reasoning behind this is that buildings are more vulnerable during works — the devastating fires at Notre-Dame and the Glasgow School of Art happened during restoration. Always contact your insurer if the work is structural, regardless of projected costs, because structural claims have the potential to be large.

Can you rely on your contractor’s insurance during the build?

Risks for the homeowner, contractor and project manager are intertwined on large-scale projects. If something goes wrong, it is in everyone’s interests that delays to completion are minimised, but if it isn’t clear who is responsible for the claim, there is huge potential for conflict and financial loss.

Traditionally, homeowners relied on their contractor’s insurance during a build. However, this can leave them in a very vulnerable position for several good reasons:

- During works, home insurance is often limited to basic perils — fire, lightning, explosion and aircraft — but other perils, such as theft and flood, are excluded.

- A contractor’s insurance will only cover mistakes made by the contractor.

- If the contractor failed to comply with their policy conditions, cover is invalidated and the claim won’t be met.

- If the claim is caused by a peril such as fire, where it may be impossible to establish how it started, both your insurer and the contractor’s own insurer may dispute responsibility, thus delaying the project and placing financial pressure on you and your contractor.

To prevent these issues occurring, specialist renovation insurance provides an excellent solution for large-scale projects. This type of policy is designed to act as an umbrella policy, paying out first, no matter who or what caused the claim.

What is the advantage of a renovation works policy?

A renovation works policy is taken out jointly by you and your project manager or architect and has numerous advantages:

- There is no long, draw-out dispute about who was responsible for the claim.

- There is only one insurer and your renovation works policy will pay out first if there is a claim.

- Your home insurance policy will not be limited to basic perils.

- A renovation works policy protects you if the contractor goes into administration or walks off the project.

- You will be compensated immediately and can, if necessary, appoint another builder to finish the project.

Planning and protecting yourself against the worst-case scenario at the start can make the experience of renovation and restoration much less stressful.

To find out more about Castleacre insurance, see the website at www.castleacreinsurance.com or call 01787 211155.

What you need to know about insuring the fine art in your home

Protecting your fine art requires a certain expertise, advises insurance expert Guy Everington of specialist fine-art insurance brokers Castleacre.

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

-

A Caribbean home with its own nightclub, down the road from a perfect beach and a pre-Columbian castle

A Caribbean home with its own nightclub, down the road from a perfect beach and a pre-Columbian castleCasa Luna is a spectacular home in a village featuring a picture-perfect beach overlooked by a Mayan castle.

By Toby Keel Published

-

Are you smarter than a 14-year-old? Country Life Quiz of the Day, February 27, 2026

Are you smarter than a 14-year-old? Country Life Quiz of the Day, February 27, 2026Today's quiz is brought to you by the off-sick-from-school 14-year-old daughter of one of the Country Life team.

By Country Life Published

-

Knight Frank's best places to live for commuters in 2026

Knight Frank's best places to live for commuters in 2026As more and more people return to the office more often, experts from Knight Frank share their tips on the best places to live for those needing to commute to London.

By Country Life Published

-

The UK’s finest High Streets and the country homes worth moving for, by Knight Frank's experts

The UK’s finest High Streets and the country homes worth moving for, by Knight Frank's expertsFrom riverbank idylls to Georgian townhouses, discover the towns where charm, character and commerce combine, and where Knight Frank has exceptional homes for sale.

By Knight Frank Published

-

A sound move: Knight Frank's experts on the grammar school catchment towns enticing a new generation

A sound move: Knight Frank's experts on the grammar school catchment towns enticing a new generationGreat towns with great schools are ideal for family life. Knight Frank's experts pick out the best in the Home Counties.

By Country Life Published

-

Knight Frank’s Eco-Friendly Homes

Knight Frank’s Eco-Friendly HomesExpert agents from Knight Frank share their wisdom on eco-friendly country houses.

By Country Life Published

-

Strutt & Parker: Property sales gather apace

Strutt & Parker: Property sales gather apaceThe year has started with a burst of positive energy in Strutt & Parker offices around the UK.

By Toby Keel Published

-

Moving to the country with Knight Frank

Moving to the country with Knight FrankWhen it matters most put your next move in safe hands with Knight Frank.

By Country Life Published

-

Mayfair International Realty: A different way of looking at real estate

Mayfair International Realty: A different way of looking at real estateTake a look at three of the most beautiful homes in New England currently on the market via Mayfair International Realty.

By Mayfair International Realty Published

-

When buying property around the world, connections count

When buying property around the world, connections countQualified local expertise essential when purchasing real estate abroad, according to the experts at Leading Real Estate Companies of the World.

By Leading Real Estate Companies of the World Published