One year on from successful merger, Murray Income keeps an eye on the long term

Charles Luke, Investment Manager at Murray Income Trust PLC, on the importance of keeping an eye on the long-term and maintaining balance as the pandemic recovery keeps producing unexpected twists.

November 2021 marks a year since the merger of Murray Income Trust with Perpetual Income & Growth Investment Trust

It is also a year since Pfizer’s announcement of promising phase 3 vaccine trials started a slow return to normal

Amid noisy markets, Murray Income has sought to keep an eye on the long term and maintain balance

A year ago, Pfizer’s announcement of promising phase 3 vaccine trials brought the welcome prospect of a return to normal. It has been a slow process, however, with many bumps along the way. In a changeable and uncertain environment for financial markets, it has been important to resist the temptation to react to short-term noise – on interest rates, on inflation and on the virus – but instead, to keep an eye on the long-term and maintain balance.

There has been a lot to distract investors over the past 12 months. The immediate aftermath of the reopening post-lockdown saw a rally in many of the world’s weakest stocks. These were companies that investors had previously thought would go bust. When it became clear they would survive, their share prices rallied. It may have been tempting to ‘lean in’ to this recovery, but those hoping for a more enduring rally in these difficult areas of the market were disappointed. Many of these companies still face structural problems even in an improving economy and could not sustain their early strength. Market leadership had changed again by the middle of the year.

Equally, throughout the year, it has become commonplace to say that the post-pandemic environment will be fundamentally different. Certainly, there are structural changes that will emerge, but much will remain the same. We do not see a changed outlook over the next 5-10 years for the majority of the companies held by the Trust and have resisted making significant changes to the portfolio in anticipation of an altered world. Where our portfolio has changed, it has tended to be because we have new ideas, rather than because the prospects for our holdings are different.

The importance of balance

The Trust has stuck to its knitting during this turbulent year. We want to find companies that can grow their earnings over the long term, believing that this is ultimately what investors will value. This will be far more important than short-term changes in interest rates, inflation or economic conditions.

Most importantly, in an uncertain world, we aim not to be exposed to any one economic scenario. One of the lessons learned from the Company’s 48 year track record of dividend growth is not to put all of our eggs in one basket. This year has shown the importance of diversification at an unpredictable time.

To help with that diversification, we continue to hold some international companies to diversify risk, such as Novo Nordisk. This international exposure can be helpful in certain industries, such as technology. We hold Microsoft in the portfolio for example. We also continue to find opportunities further down the market capitalisation scale – we currently have double the mid-cap weighting of the index.

The merger and beyond

November 2021 also marks a year since the merger of Murray Income with Perpetual Income & Growth and there have been some clear advantages for both existing and new shareholders. In boosting the assets to over £1 billion, the merger has improved liquidity in the Trust. Trading volumes are higher and the bid-offer spread has been reduced. Most significantly, the benefit of economies of scale has resulted in the ongoing charges ratio falling from 0.64% to 0.46%.

The case for focus on dividend growth is as strong as it has ever been. Academic evidence suggests that dividend growth is a key driver of equity returns. While the Bank of England has said interest rates will ultimately move higher, any rises are likely to be small and will not solve the income dilemma for investors. It will still be difficult to get inflation-beating returns from a savings account, or from government bonds. Equally, dividends remain the touchstone for the quality of companies. If a company is striving to grow its dividend, it should invest wisely and act prudently.

The UK still has one of the highest yields of any equity market. More importantly, those dividends are more resilient post-pandemic. Dividends have been rebased where dividend cover was stretched, ensuring that companies are not over-reaching to fund payouts to shareholders. Management teams are noticeably more confident on their ability to grow dividends over the longer-term.

Valuations are also more attractive in the UK market than elsewhere. While the UK market has recovered somewhat since the start of the year, it remains out of favour with international investors and there is scope for this to improve. UK companies should ultimately be recognised for their quality, their competitive advantages and their good governance. This is already being recognised by private equity buyers across the world. Within the portfolio, asset management services group Sanne and infrastructure provider John Laing have received private equity bids this year.

It has been an unpredictable year, where investor sentiment has bounced around. It has been vital to see through the noise and look to the long-term prospects for companies. A balanced portfolio that can steer a path through turbulent times should deliver a smoother ride for investors.

Companies selected for illustrative purposes only to demonstrate abrdn’s investment management style and not as an indication of performance.

Important information

Risk factors you should consider prior to investing:

- The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- The Company may charge expenses to capital which may erode the capital value of the investment.

- Derivatives may be used, subject to restrictions set out for the Company, in order to manage risk and generate income. The market in derivatives can be volatile and there is a higher than average risk of loss.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid-offer spread. If trading volumes fall, the bid-offer spread can widen.

- Certain trusts may seek to invest in higher yielding securities such as bonds, which are subject to credit risk, market price risk and interest rate risk. Unlike income from a single bond, the level of income from an investment trust is not fixed and may fluctuate.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

Other important information:

Issued by Aberdeen Asset Managers Limited which is authorised and regulated by the Financial Conduct Authority in the United Kingdom. Registered Office: 10 Queen’s Terrace, Aberdeen AB10 1XL. Registered in Scotland No. 108419. An investment trust should be considered only as part of a balanced portfolio. Under no circumstances should this information be considered as an offer or solicitation to deal in investments.

Find out more at www.murray-income.co.uk or by registering for updates. You can also follow us on social media: Twitter and LinkedIn.

GB-101121-160772-1

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

-

A Georgian lodge tucked away on a 900-acre National Trust estate in one of the most beautiful settings in Pembrokeshire

A Georgian lodge tucked away on a 900-acre National Trust estate in one of the most beautiful settings in PembrokeshireA Georgian lodge has come up for sale on a National Trust-owned estate, just a short walk from one of the prettiest beaches in Wales.

-

‘I’m like: “Give me those tights, let me show you”: Ballet superstar Carlos Acosta’s consuming passions

‘I’m like: “Give me those tights, let me show you”: Ballet superstar Carlos Acosta’s consuming passionsBorn one of 11 children in a Cuban slum, it’s been 36 years since Carlos Acosta’s career as an internationally famous dancer formally began. Lotte Brundle meets him at the Birmingham Royal Ballet, where he is the director.

-

The timeless appeal of Vaughan and the secrets of good lighting to be unpacked by four of Britain's top designers

The timeless appeal of Vaughan and the secrets of good lighting to be unpacked by four of Britain's top designersFor more than four decades, Vaughan has combined inspiration from past and present to create beautifully crafted lighting, furniture and textiles that will stand the test of time.

-

FREYWILLE: Works of art

FREYWILLE: Works of artFamous paintings by some of the greatest artists the world has ever seen are the inspiration behind exquisite new collections created by jeweller FREYWILLE.

-

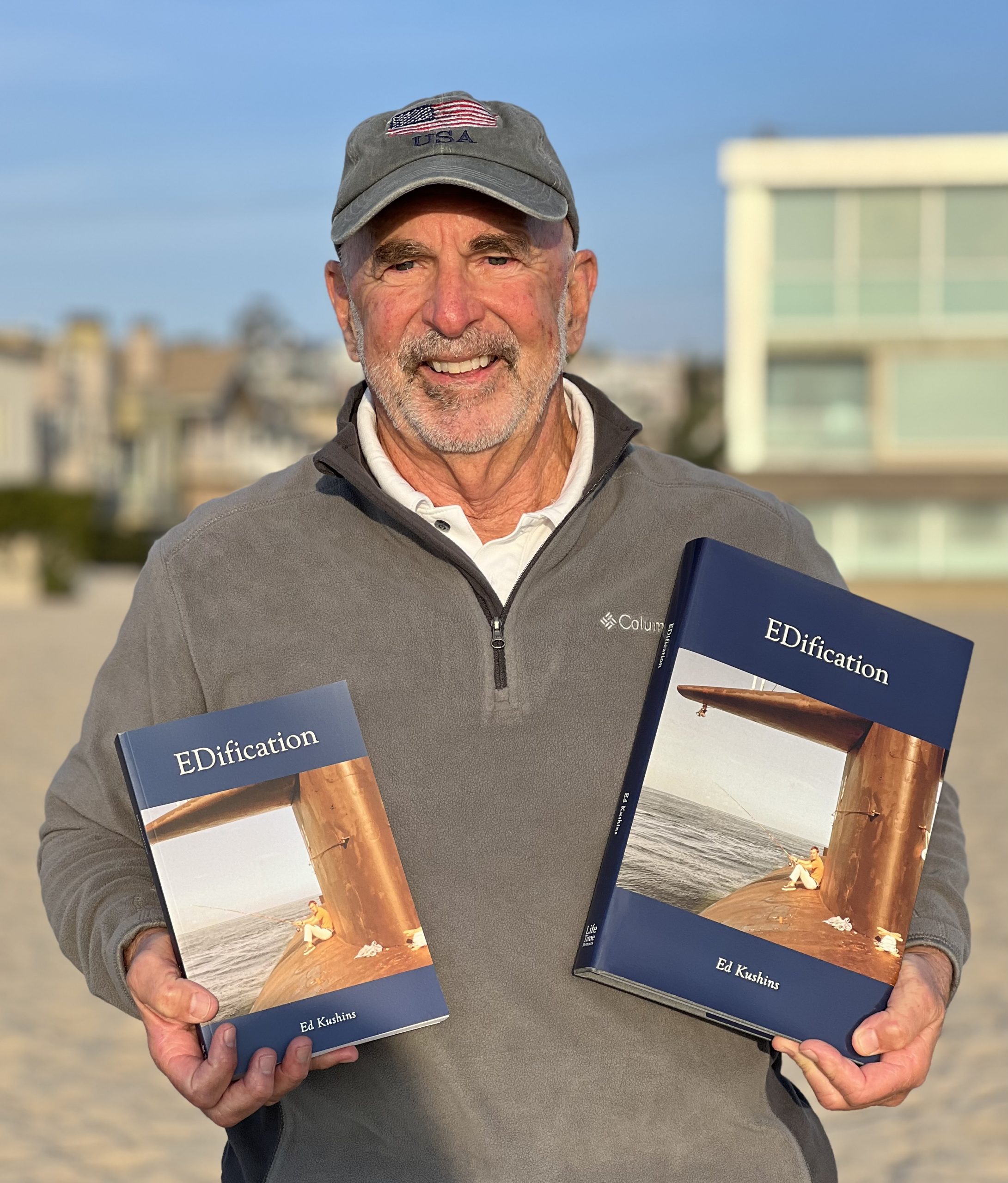

LifeBook: The easy way to turn your life into the story of a lifetime

LifeBook: The easy way to turn your life into the story of a lifetimeEd Kushins enjoyed an incredible journey when he asked LifeBook Memoirs for help in writing his life story. Let LifeBook help you to create yours — a memoir or autobiography for your loved ones and future generations.

-

Six of the finest islands in the Caribbean, as picked out by the experts at Turquoise

Six of the finest islands in the Caribbean, as picked out by the experts at TurquoiseThe Caribbean is a winter sun favourite for good reason but how do you decide which island to book? The Turquoise Holiday Company, which creates bespoke trips based on firsthand knowledge, has the answer.

-

Fine Art Lighting: Making light work

Fine Art Lighting: Making light workBeautifully lit paintings and prints that have been expertly positioned and displayed will transform any interior, says the Hon Patrick Howard, founder of Fine Art Lighting.

-

How The Cornish Bed Company is reviving the lost art of Victorian bed making

How The Cornish Bed Company is reviving the lost art of Victorian bed makingIn a historic steam engine shed in St Austell, The Cornish Bed Company has revived the lost art of making cast iron beds by hand that will stand the test of time.

-

Will the Chinese tiger pounce in 2022?

Will the Chinese tiger pounce in 2022?Will the Year of the Tiger bring prosperity for China and its investors? There are tentative signs that the tide is turning.

-

Christening and Confirmation presents to cherish for a lifetime, from Cassandra Goad

Christening and Confirmation presents to cherish for a lifetime, from Cassandra GoadWhen it comes to Christening and confirmation presents, Cassandra Goad has something for all.