Planning beyond your future

The number of people being hit by inheritance tax has soared in recent years, yet many of us have no idea if our beneficiaries will be liable and what to do if we are. The experts at Investec Wealth & Investment (UK) can help.

Once a problem faced only by the very wealthiest landowners, inheritance tax (IHT) now hits more people than ever before. The number of estates incurring the charge almost doubled from 15,000 to 27,000 in the past ten years — and is set to keep growing.*

Thankfully, there are plenty of things that can be done to mitigate how much you’ll have to pay, as Faye Church, senior financial planning director at Investec Wealth and Investment (UK) explains.

How do I know if I’ll have to pay IHT?

The short answer is that, for married couples who own a property, IHT is usually due if their estate is worth more than £1 million. Dig a little deeper and it’s more complicated. There is a £325,000 nil rate band available to everyone and an additional £175,000 residency nil rate band available to those who own a property and leave it to direct descendants, although this is reduced if the total estate is above £2 million.

There’s no inheritance tax to pay between spouses and a spouse also passes on their IHT nil rate band to their widow or widower (it’s one of the few tax breaks remaining for married couples). So, a couple with a property could have £1 million of their estate fall under the IHT threshold, providing certain conditions are met.

Why are so many more people liable to pay IHT these days?

Quite simply because IHT allowances haven’t kept up with inflation. The £325,000 nil rate band has stayed frozen since April 2009; if it had risen with the cost of living, the Bank of England says it would now be £495,550.

Inflation is only a part of the picture, however: the biggest asset within most people’s estate is their property and property prices since 2009 have risen even more than other costs. A couple who owned a property worth £600,000 or more** at the time will now more than likely find it is above the £1 million IHT threshold.

"Involve your children in any discussion around inheritances, to ensure that any plans you make are understood by everyone when the time comes"

Does everything I own count towards the size of my estate for IHT purposes?

Most assets do fall within an estate for IHT purposes, but there are exceptions. Gifting is the most common example: gifts given to friends or family are exempt from IHT as long as the donor survives for seven years.

Gifting within their lifetime is something we see a lot with clients who have the capacity to do so. There are rules allowing a £3,000 annual gift exemption, small gifts of up to £250, marriage gifts and more. The most common thing we see is parents and grandparents helping their family get on the property ladder. For those families that want to save on inheritance tax but do not want to relinquish control of their assets, they can do so via gifting into trust or using investments that attract business relief. This way, the client retains control of who can benefit and when (which only require the donor to live for two years to be exempt from IHT).

What else should I know about gifting during my lifetime?

Be ready to face a few awkward conversations: talking about what happens after the end of our lives hardly makes for entertaining dinner parties and children, in particular, can find it difficult to discuss these things with their parents. Time and again, we hear of the next generation telling their mothers and fathers, ‘Just spend it’, rather than worrying about IHT planning. But as you get older, it does make sense to involve your children in any discussion around inheritances and inheritance tax, to ensure that any complex plans put in place are understood by the family. That way, when the time comes, everyone will know where they stand.

If you’ve watched Succession most of us probably associate trusts as something for the very wealthiest of families. Can they make sense for people with more modest levels of wealth?

Trusts aren’t just for the rich, and they also don’t have to be expensive to set up. We have a number of clients who use trusts as a way of retaining some control of their assets in their lifetime, while still keeping them out of their estate for IHT planning purposes. It’s important to realise, however, that anything kept in trust is no longer yours to do with as you wish: think of it as retaining an influence on how the assets are managed and who they benefit.

What’s the first step I need to take?

If you don’t already have one, make sure you have a will—if you don’t, your estate will follow the strict and inflexible rules of intestacy. It’s also a very good idea to consider taking professional IHT advice, because these are complex matters with large sums involved. When clients come to us, we’ll assess their IHT liability and work with them to find out what’s important to them, to what extent they wish to mitigate any inheritance tax due and help them with cash flow planning to quantify whether gifts are affordable. We can then advise on the most appropriate solutions to obtain the best outcome for all concerned— and we’re always happy to review the plan on a regular basis, since we know that life can change.

Call Investec Wealth & Investment (UK) on 0808 164 1234 for a confidential, no-obligation chat, or visit www.investecwin.co.uk.

* Gov.uk - Inheritance Tax statistics: commentary 2023 ** Nationwide House Price Index figs

The contents of this article do not constitute a personal recommendation or advice. It is important to consult a professional adviser before taking any action. Tax treatment depends on the individual circumstances of each client and may be subject to change in future. All statements concerning tax treatment are based upon our understanding of current tax law and HMRC practice and can be subject to change.

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

-

This Civil War coat and armour has survived four centuries in almost perfect condition — apart from the hole made by the musket ball that killed the man who wore it

This Civil War coat and armour has survived four centuries in almost perfect condition — apart from the hole made by the musket ball that killed the man who wore itJohn Goodall visits Doddington Hall in Lincolnshire to discover the tale of one of its most extraordinary artefacts: the coat worn by a 17th century nobleman when he was killed during one of the key battles of the English Civil War.

-

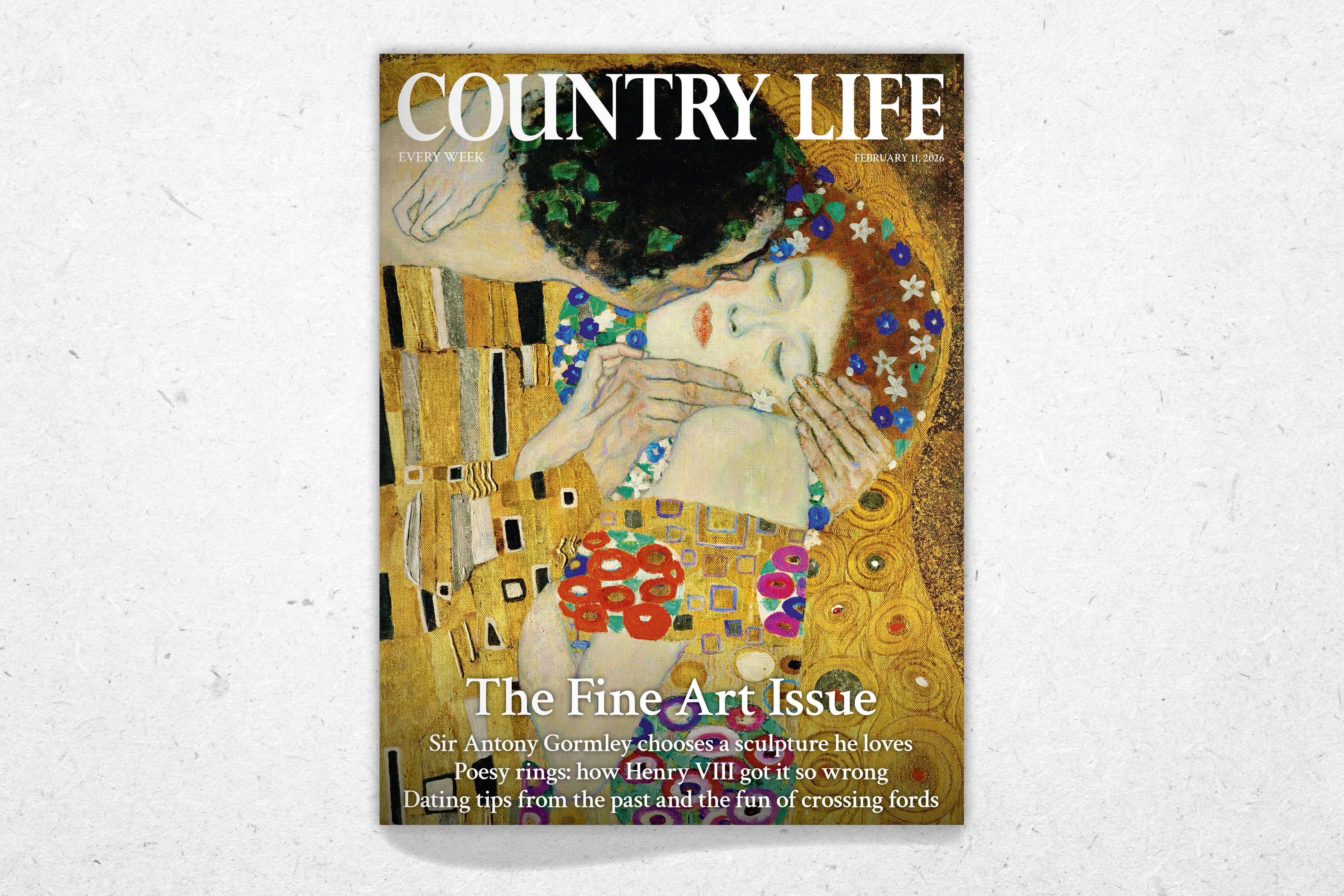

Country Life February 11, 2026

Country Life February 11, 2026Country Life February 11, 2026, is our fine art issue, featuring Seurat, art in literature and Sir Antony Gormley, plus Ampthill Park House and the long-eared eagle owl.

-

Plant trees for pollinators in need with the Woodland Trust

Plant trees for pollinators in need with the Woodland TrustWe can’t live without the industrious insects that pollinate our crops and support our ecosystem. Many of their populations are in decline, but you can help by creating a haven of nectar and nesting sites on your land this planting season.

-

The Welsh Way

The Welsh WaySustainable, ethical and unmatched for taste, Welsh Lamb is as good as meat gets.

-

How planting trees can fight flooding and improve your soil

How planting trees can fight flooding and improve your soilRecord-breaking rainfall and a changing climate convinced Leicestershire farmer Rachael Spence that she needed to find a way to combat flooding and improve her soil. The answer? Planting more trees, which have helped reduce flood risk and future-proof her land and business.

-

The call of the wild, from gliding past hippos on a mokoro to riding alongside cheetahs and giraffes

The call of the wild, from gliding past hippos on a mokoro to riding alongside cheetahs and giraffesWhether following migrating wildebeest on foot, gliding past hippos on a mokoro, or riding alongside giraffes, little beats the thrill of an Aardvark safari.

-

The safaris that deliver wild encounters for the whole family

The safaris that deliver wild encounters for the whole familyAardvark Safaris create tailor-made wildlife trips in Africa to thrill all ages.

-

Restore the natural balance on your land with trees

Restore the natural balance on your land with treesPlanting trees isn't just about how they look — they can help increase biodiversity, provide shelter, prevent soil erosion, reduce flooding and much more, as more and more farmers are finding.

-

The Country Life colour edit, with Wallpaper Direct and Designer Paint

The Country Life colour edit, with Wallpaper Direct and Designer PaintWhen decorating a country home, Wallpaper Direct and Designer Paint make a huge range of inspiring wallpapers and paints available at the press of a button.

-

How to get your outdoor spaces scrubbed up and ready for outdoor entertaining

How to get your outdoor spaces scrubbed up and ready for outdoor entertainingMany of us almost lived outside during the long hot summer, but these days the end of the hot weather doesn't mean we head back inside until spring. If you're looking to spruce up your outdoor living space, here are some tips for getting things back to their best.