Can you combine growth and ESG in one investment portfolio?

Martin Currie Global Portfolio Trust offers a combination of top sustainability ratings without compromising on growth potential.

When investing, it’s natural to want to increase the value of our wealth – but it’s increasingly combined with a desire to take serious notice of environmental, social, and governance (ESG) factors. But with so many funds labelled as Sustainable or ESG, ‘greenwashing’ has become an issue that has hit the headlines. So how can investors judge the validity of claims made?

Many companies are taking steps to reduce their environmental impact, or developing innovative long-term solutions that will help sectors to minimise the negative effect.

Highly rated for ESG

The specialist investment manager, Martin Currie is a recognised leader in the field of ESG, becoming a signatory to the Principles for Responsible Investment (PRI) agreement in 2009, and ever since, it has been advancing its knowledge and understanding of responsible investing, while also searching the world for companies.

One of its leading investments is Martin Currie Global Portfolio Trust, a global equity portfolio that includes some of the world’s leading companies, and it aims to deliver returns that are higher than the global equity markets. It offers a ready-made portfolio with exposure to a range of exciting international markets that could be tricky for individuals to replicate and manage.

The investment team, led by Portfolio Manager Zehrid Osmani, undertakes a rigorous analysis of companies in order to handpick just 25-40 of the most exciting ideas from around the world. Typically, they seek companies that are exposed to multi-decade growth ‘megatrends’ such as the rise of electric vehicles, the growth of the emerging market middle class and the onset of artificial intelligence.

A rigorous research approach

Osmani believes that ESG analysis is essential to understanding any company and assessing its long-term growth potential.

The team at Martin Currie evaluates, measures and scores over 50 individual criteria for every company it considers, a very active approach to assessing the ESG risks in a systematic way that allows for benchmarking and comparison of companies across industries and countries. The analysis also assesses companies in the supply chain of stocks under scrutiny in a bid to highlight any potential issues. While there are no guarantees, for a long-term investor, this depth of analysis and interrogation helps build a clearer picture and provides valuable input to the wider stock selection process.

And the fruits of his labour are clear to see through his track record, including ESG credentials.

Morningstar, a global fund ratings agency, independently assesses portfolios all around the world on performance and also evaluates ESG and Sustainability factors.

As of July 2023, it ranks Martin Currie Global Portfolio Trust in the top 1% globally out of 7,907 similar products (categorised as Global Equity Large Cap).

It has also awarded the trust with a Sustainability Rating™ of '5 globes' the highest possible and also a Low Carbon Designation™ which means the portfolio has low exposure to fossil fuels and is an indication that the companies in the portfolio are in general alignment with the transition to a low-carbon economy*.

These first-class ratings recognise the high standards and pioneering in-depth analysis undertaken as part of the stock selection process.

The approach the team uses to analyse and assess companies on their ESG criteria is highly differentiated. Many managers outsource the process or simply place a lot of emphasis on the E or environmental part of the equation.

Martin Currie looks at individual companies' environmental ratings, but that’s just part of the process. The analysts also consider all the companies in the supply chain which “can expose a company to hidden and potentially material risks” as they tend to be complex and opaque.

The trust is also rated one of the best in the sector for Social factors (the S in ESG) and this is an area the team has specifically been focusing on.

In addition to the 50 ESG criteria, they have introduced a second layer of 18 measures to underpin the analysis of Exploitation risk, which is one of our criteria. We spend time looking at issues relating to: labour rights, human rights, working conditions (accidents, fatalities, safety), age & gender exploitation.

The team studies factors such as employee welfare, management diversity, cybersecurity and greenhouse gas emissions. As the company notes, better employee welfare and corporate governance structures are linked with “better corporate returns.”

Businesses found to be exploitative are likely to face a serious backlash from consumers, and regulators. Fines and penalties are only getting harsher as policymakers try to hold businesses accountable to global standards.

The team want to avoid these disasters before they happen - no investor wants to own part of a company which is caught breaking the law, has to pay huge fines and loses customers in the process.

As a result, the team will only add companies to the portfolio after a detailed assessment of all of the 50 strict E, S and G risk criteria it has set out and continues to refine.

The role of cybersecurity

Cybersecurity is one of those areas of Martin Currie’s ESG framework that stands out as having a unique quality.

Most investors might question where cybersecurity fits in an ESG framework. The answer is data breaches can have a “negative impact on trust, brand image, legal implications and ultimately, the long-term sustainability of any business model.” Regulators can fine companies significant sums if they're found to have cut corners or not protected consumers’ data sufficiently.

Martin Currie Global Portfolio Trust’s team sees both an opportunity and risk here. On the one hand, they want to be sure they’re only backing businesses with top-quality cyber defences. But on the other, global cyber spending has ballooned in recent years, and there’s a clear opportunity for the market leaders to grab a big share of the market.

The trust is investing in this theme and the tech sector in general in many ways. These include investments in household names at the cutting edge of quantum computing through to the leading semiconductor manufacturers who make chips to meet rising global demand.

Martin Currie Global Portfolio Trust offers investors access to the growth potential of investing in a portfolio of 25-40 of the world’s best companies, without compromising ESG credentials – in fact, the investment team believe that companies that have the best approach to a sustainable future will help them perform.

To find out more visit: martincurrieglobal.com

* Source for Morningstar data and ratings: Morningstar ©June 2023 Morningstar, Inc. All rights reserved

Important Legal Information

This information is issued and approved by Franklin Templeton Investment Management Limited (FTIML). It does not constitute investment advice.

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Past performance is not a guide to future returns. The return may increase or decrease as a result of fluctuations in the markets, in currency and/or in the portfolio.

Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The analysis of Environmental, Social and Governance (ESG) factors form an important part of the investment process and helps inform investment decisions. The strategy does not necessarily target particular sustainability outcomes.

The opinions contained in this document are those of the named manager(s). They may not necessarily represent the views of other Martin Currie managers, strategies or funds.

Shares in investment trusts are traded on a stock market and the share price will fluctuate in accordance with supply and demand and may not reflect the value of underlying net asset value of the shares. The majority of charges will be deducted from the capital of the company. This will constrain capital growth of the company in order to maintain the income streams.

There is no guarantee that Martin Currie Global Portfolio Trust will achieve its objective. Please consult your financial adviser before deciding to invest.

Further reading

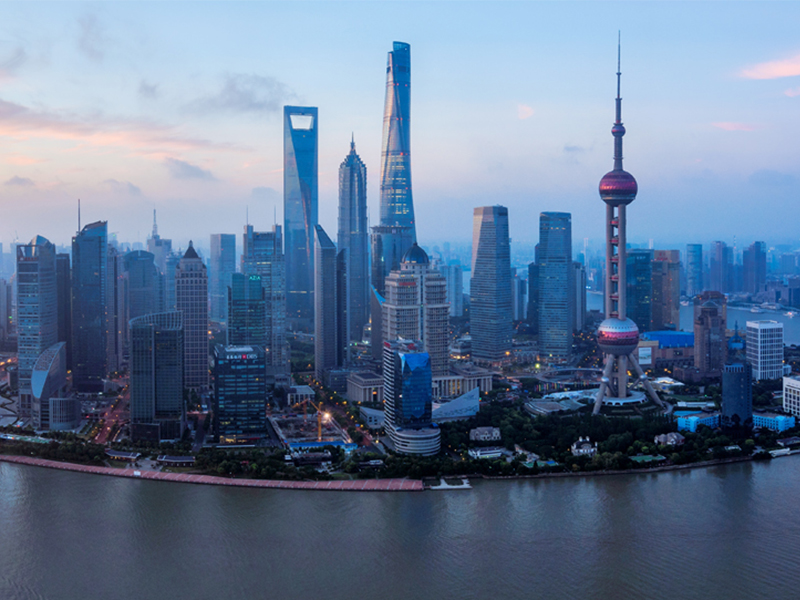

How to invest in China — without investing in China?

China offers investors an exciting opportunity. It is a huge market and it has many supportive long-term trends underpinning its future growth potential, including rising wealth and infrastructure development. Read more.

What can equity investors learn from the world cup?

The World Cup – the lessons for growth investors

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

-

How well do you know these fictional friends and foes? It's the Country Life Quiz of the Day, February 16, 2026

How well do you know these fictional friends and foes? It's the Country Life Quiz of the Day, February 16, 2026From modern favourites to classic icons, they’re all here, so let's put your knowledge to the test.

-

These are a few of James Haskell's favourite things

These are a few of James Haskell's favourite thingsThe former rugby forward talks to Hetty Lintell. Illustrations by by Ollie Maxwell.

-

Reimagining the past at Vaughan

Reimagining the past at VaughanIn September 2025, leading designers shared their views on creating interiors with the capacity to last forever.

-

Tetrad: Over half a century of timeless good looks

Tetrad: Over half a century of timeless good looksSince 1968, Tetrad has employed a combination of traditional skills and the finest materials to make upholstered furniture that is designed to offer years of comfort.

-

Reimagining the past: A panel discussion with Vaughan

Reimagining the past: A panel discussion with VaughanAt Focus/25 later this month, Vaughan will host an inspiring talk at which leading names in antiques and interiors will explain why understanding the past is vital to designing for the future.

-

Star of the show: Rose of Jericho's paint created just for Country Life at RHS Chelsea

Star of the show: Rose of Jericho's paint created just for Country Life at RHS ChelseaOne of the highlights of Country Life's ‘outdoor drawing room’ at the 2025 RHS Chelsea Flower Show was a new paint colour created by Rose of Jericho,

-

Munder-Skiles and the art of exterior decoration

Munder-Skiles and the art of exterior decorationThe success of this project — which was awarded four stars by judges at the Chelsea Flower Show — demonstrates Isabella Worsley’s versatility as a designer.

-

Sell your valuables with ease with The Antique Buying Collective

Sell your valuables with ease with The Antique Buying CollectiveThe Antique Buying Collective treats gold and silver as heirlooms, not scrap. From Victorian brooches to Georgian silverware, each piece is appraised for its history, craftsmanship .and charm, then thoughtfully rehomed through a trusted network. It’s a respectful approach, giving fine antiques the second life they so richly deserve

-

Great garden getaways

Great garden getawaysDiscover some of Britain’s finest gardens with a PoB Hotels break

-

Reader Event: Designing spaces that feel like home

Reader Event: Designing spaces that feel like homeOn Wednesday, March 26, interior-design studio Sims Hilditch and George Smith, makers of luxury, handcrafted upholstered furniture, will mark the launch of new furniture designs for bedrooms in an event chaired by Country Life.