'We’re in the golden era of family life': The rather lovely accidental up-side of the wildly spiralling cost of housing

House prices have massively outstripped rises in average income in the last few years, according to new research — yet it's not all bad news. Toby Keel reports.

It's never been harder to buy a house, raise kids and have a successful career.

That's the inescapable conclusion to draw from new research by estate agents Jackson-Stops, who have just published a report showing how the costs of buying a house and looking after children has soared upwards far faster than wages.

'The data is stark,' they say. 'Average house prices have risen 61.7% since 2014, whilst wage growth has stagnated across the decade at just 10.7%.'

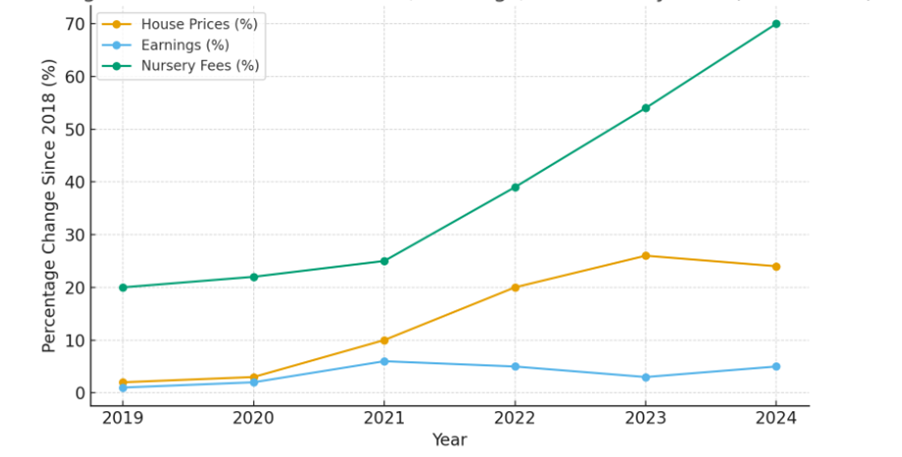

And it's not just house prices rising: nursery fees have ballooned as well, 'with average monthly nursery fees for children under-two increasing by 70% since 2018'. Combine that, say Jackson-Stops, with a healthy birth rate, nurseries struggling to make ends meet amid National Insurance rises, and a 35% drop in the number of registered childminders since 2018, and something has to happen to keep the whole system rolling.

That something, it turns out, is grandparents. This, the estate agents say, is the era of the ROGER: 'Reliant On Grandparents and Equity Release'. Parents of young children are increasingly leaning on their parents to both fund house purchases, and then to provide free childcare.

That grandparents are giving back is heartwarming, for it's not so long ago that the overwhelming story we heard was of bitterness towards older people who built up great wealth via the housing ladder. And in truth it's not hard to see why Millennials and Gen Z-ers give the older generations grief about how easy they had it with buying houses. In the 1960s and 1970s the average house cost just three times the average salary. These days houses cost around nine times more than the average wage — it's even higher in London — meaning that you need the power of two combined salaries to be able to get a mortgage big enough to buy even a modest home.

Combining that with the rising childcare costs — which are having a serious impact despite the government's provision to fund up to 30 hours a week of childcare for working parents — and it's not surprising that the Bank of Mum and Dad is now also the Nursery of Mum and Dad.

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

Changes since 2018: house prices, earnings and nursery fees.

Source: Jackson-Stops

But that does mean one thing: young families are living closer to their own parents than they have done in generations.

'Just like the laws of property, the demand and supply of childcare is impacting moving decisions and migratory trends across the country,' says Nick Leeming, chairman of Jackson-Stops.

'As childcare becomes the new postcode priority, we’re seeing three generations reshaping the market: grandparents relocating to be the "village" young parents need, and young parents moving closer to home to help support their little ones.

'Millennials who are often hit hardest by affordability pressures, now in the 30s and 40s with families of their own, were also the generation that used a new dominant market lender: the bank of Mum and Dad. Often from equity release of those who benefitted the most from house price inflation since the early 2000s, this was key to many getting on the ladder in the first place. These tight family networks are once again driving where people live.'

Jackson-Stops don't spell it out, but this change does create a new form of inequality: those whose parents are still working, or who are deceased, or who are unable (or unwilling) to move their lives around to look after grandchildren.

But for those able to take advantage of this multi-generational set-up, relationships across the ages have become a wonderful positive.

'The Silent Generation’s typical parenting style was hands-off, with arguably less of a need placed on them compared to the financial pressures on young families that we see today,' Leeming adds.

'In many ways, families are closer than ever before — an unexpected upside of shifting socio-economic dynamics. We’re in the golden era of family life.'

Toby Keel is Country Life's Digital Director, and has been running the website and social media channels since 2016. A former sports journalist, he writes about property, cars, lifestyle, travel, nature.