Wealthy Boomers collected blue-chip paintings. Gen Z is opting for collectibles. Who will come up trumps?

Handbags, jewellery and luxury vehicles are the aesthetic investments of choice for today’s high-net-worth youth, says a report by Art Basel.

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

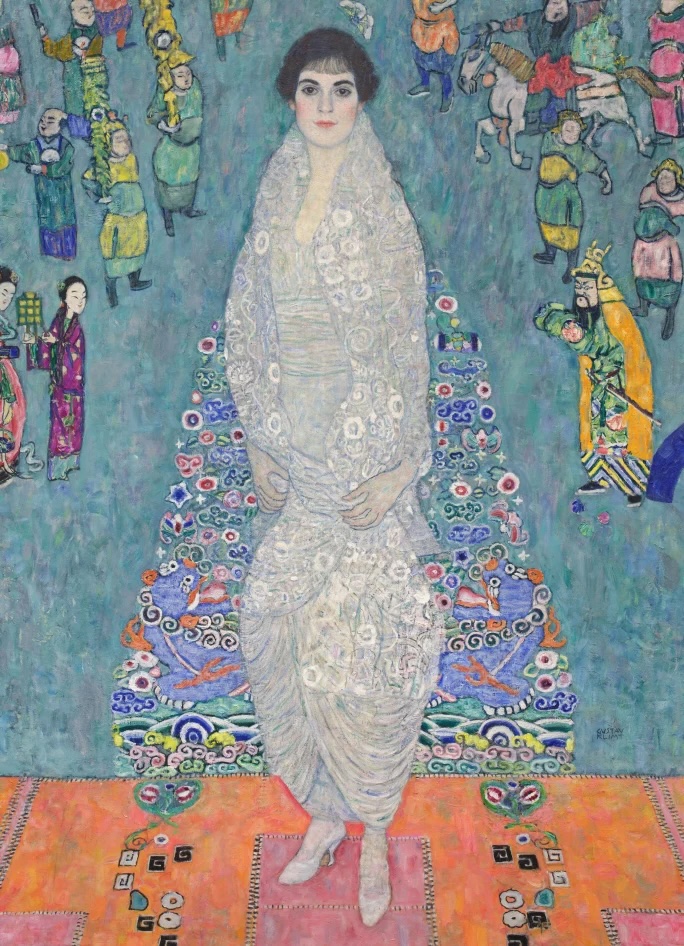

I went to the Leonard Lauder Collection auction preview at Sotheby’s New York, thinking I’d better see the Klimt paintings and Matisse bronzes before they’re returned to private hands. I arrived at Sotheby’s new home, in the Breuer Building on Madison Avenue, to find that others had the same idea. The line to get in stretched out the door, around the corner of Madison and 75th, and down 75th to Park. The ‘feels like’ temperature of -2℃ seemed to deter no one from waiting. I got in line.

What was it, really, that we’d come to see? The works inside were modern masterpieces, but the turnout felt bigger than the catalog’s sum. Lauder died in June at 92. Had we sensed that as he and other great art patrons of a certain age shuffle off this mortal coil, their way of collecting is vanishing, too, and we’d better bear witness while we can? Lauder was a connoisseur, which in the collecting world means someone who acquires art passionately, knowledgeably and often quietly. Autumn 2025’s marquee auctions, which also included the Cindy and Jay Pritzker Collection at Sotheby’s (Van Gogh, Kandinsky, Gauguin) and the Robert and Patricia Weis Collection at Christie’s (Rothko, Picasso, Mondrian), were collectively an ode to old-school connoisseurship.

Today’s new buyers find themselves on the receiving end of the largest intergenerational wealth transfer in history, not to mention having made their own ways in lucrative sectors like technology and finance. How, then, are they going about the business of collecting?

Very differently than your Lauders or Pritzkers, according to research. A report by art-fair behemoth Art Basel and UBS, Survey of Global Collecting 2025, says that of spending by high-net-worth individuals on art and collectibles in the first half of 2025, Baby Boomers (born 1946-1964) accounted for the highest share in fine art, antiques and watches. Millennials (1981-1996) led the spending in decorative art, design, and jewellery and gems. And Gen Z (1997-2012), representing a whopping 56% of all collectibles spending, had the highest averages in most other categories, including luxury handbags, collectible trainers, and classic cars, boats and jets.

Sotheby's now has a dedicated collectible trainers — or sneakers in the USA — section, including shoes signed by sporting giants such as Michael Jordan, Kobe Bryant and Lebron James.

To see whether Art Basel’s findings rang true with those in the collecting trenches, I talked to more than a dozen industry players on both sides of the Atlantic — collectors, collection advisers, gallery owners, and leaders at art fairs and auction houses. While they generally said Art Basel’s assessment reflects what they’re seeing, they were eager to point out other patterns among young people who are collecting art.

Cameron Carani is a Gen Z collector who’s active at major museums in Miami (where he’s based), New York (where he’s also based) and Paris, including serving on the board of the Young Patrons Council of The Museum of Modern Art. With his partner, Cameron collects contemporary oil paintings, bronze works and clay ceramics.

Cameron says he’s ‘not surprised’ by his peers’ reported preference for what he points out are ‘mobile, transportable’ items. ‘Respectfully, these are also commonly ostentatious things that photograph well. Including myself here: as Gen Z matures, I think our collectibles will be less about loud display and morph into being more personal and quiet.’ Like his Japanese wood-fired ceramics, for example.

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

Millennial collector Eden Xu-Martinez, who’s on the Contemporary Arts Council of MoMA and the Young Collectors Council of the Guggenheim in New York, says she and her husband started their collection with paintings and sculptures by contemporary artists represented by blue-chip galleries and have since embraced emerging creatives. Recent art-buying in Paris yielded a Pat Steir painting and a work by a young German artist for less than $1,000.

What each generation chooses to collect is a function of their financial means and how they wish to express themselves, Eden says. ‘Boomers, having accumulated wealth over decades, gravitate toward high-value, lasting assets like fine art and antiques that carry historical weight and prestige. Millennials often favour pieces which combine aesthetic appeal with functionality and fit into transitional life stages like moving homes, building careers or raising families. Gen Z’s collecting behaviours, on the other hand, reflect immediacy, visibility and cultural dialogue. Trainers, handbags and other lifestyle collectibles are often highly social objects as symbols of taste, influence and belonging in digital and offline communities. For them, aesthetics is inseparable from identity and storytelling.’

Cameron Carani and his partner Todd White, founder of Dry Farm Wines, collect ceramic objects, including this piece by Jane Yang d'Haene, among other things.

The drive to express one’s identity, to tell one’s story, cuts across generations; what makes aesthetics so integral to Gen Z’s efforts is social media. To be seen amid the content overload, acts of expression must be conveyed with immediacy, which is to say, visually. Because the message is styled, not spoken, the accoutrements one is seen with in a ‘photo dump’ or ‘day-in-the-life’ reel become freighted with meaning, communicating emotions, beliefs and values.

Furthermore, as Gen Z famously prioritises experiences, it’s no surprise that the assets Art Basel says they’re disproportionately buying are things that lend themselves to said experiences. The jet-setting Gen Z-er happily takes a designer bag, Swiss watch or other wearable symbol of identity along; they’re not going to bring an oil painting on their excursion. At the heart of such storytelling is the search for connection. Style tribes are nothing new, but for digital natives who rely so heavily on visual cues, every object in one’s reach has the potential to signal belonging to a community or embracing shared values like sustainability and inclusivity.

Powerhouse art adviser Allan Schwartzman tells me that, while his clientele does include some young people who are collecting art in the time-honoured, connoisseurial way, ‘many younger collectors are disconnected from the passion and engagement with artists and the institutions that support the ecosystem of art that marked earlier generations of collectors of postwar art’. Allan says younger generations prefer to collect ‘across the market’, seeking out overlooked historical artists and emerging artists. Of course, this is also a form of supporting the arts ecosystem; many people I talked to praised young collectors’ championing of female artists, artists of colour, and others from historically underrepresented demographics who would otherwise struggle to be seen — further proof that for young generations, aesthetics are tied to values and identity.

‘If it were in purely simplistic terms’, Will Korner, head of fairs at The European Fine Art Fair (TEFAF), says of the generational trends, ‘one could say that Boomers tend to collect with a focus on connoisseurship, provenance and long-term value, often building coherent collections and prioritising passion and legacy due to their age group. Gen X (1965-1980) tends to blend traditional and modern approaches, balancing personal taste with investment considerations. Millennials and Gen Z are more visually and socially influenced, drawn to lifestyle and cultural connection as well as trends, but they are increasingly curious and open to learning about the context and history of the pieces they collect.’

Artist and model Kesewa Aboah attended a 2025 Frieze Masters dinner, held in collaboration with Katie Grand and Perfect Magazine. She's created multiple works of art for Huntsman Savile Row.

Art Basel’s broad findings notwithstanding, there’s plenty of evidence that younger generations intend to invest in art. Crowds at the recent Frieze London skewed notably young; one source said a generational ‘changing of the guard’ was palpable. In New York, last year’s Young Collectors Night at The Winter Show antiques fair was particularly vibrant, with 800 in attendance and Gen Z design darling Adam Charlap Hyman in the spotlight. The London gallery scene is booming, with new spaces opening not in Mayfair or Belgravia, but across the city’s east and south; they are experimental and energetic.

Young collectors are striving to create a personal narrative, and they’re doing so with less regard for chronological boundaries than earlier generations, says Emanuela Tarizzo, director of Frieze Masters. ‘So while different generations may gravitate toward different categories, the unifying theme is that collectors, whatever their age, are searching for stories that resonate with them, and for a sense of discovery.’ Younger collectors are turning to classical art in meaningful numbers, Emanuela says, and Frieze is responding with new initiatives like ‘Reflections’, which shows historical art alongside contemporary works.

Which generation's collections will be worth the most if they sell it all down the line? The annual Luxury Investment Index by Knight Frank offers clues. According to the 2025 report, values for a basket of ten passion investments — handbags, jewellery, wine and other collectibles, with art included — fell by an average of 3.3% in 2024. Of these categories, handbags were the best-performing investment, with values slightly increasing by 2.8%. (‘The ultimate classic handbag, the Hermès Birkin in black Togo leather, is now more valuable than ever when sold on the secondary market’, the report says, quoting Art Market Research.) Fine art alone, meanwhile, was down considerably more than the total basket, falling 18.3%.

The longer view is brighter for all categories, rest assured. The index reports ten-year value growth for handbags at 85.5%; jewellery, 33.5%; watches, 125.1%; and furniture, 140.9%. Art sits comfortably in the middle of the growth range, at 54.0%.

For a more anecdotal data point, consider the results of the Leonard Lauder sale and the season’s other auctions of connoisseurial collections. Together they brought in more than $2 billion.

Art and collectibles have historically been considered ‘investments of passion’; you don’t invest in them strictly for the returns. Whether you’re buying a handbag or a Hockney, though, you want to think the thing will at least hold its value.

Owen is Country Life’s New York arts and culture correspondent. Having studied at the New York School of Interior Design, his previous work includes writing and styling for House Beautiful and creating watercolour renderings for A-list designers. He is an unreconstructed Anglophile and has never missed a Drake’s archive sale.