-

Five Cotswold dream homes on the market from £3m to £18m, as seen in Country Life

By Toby Keel

-

-

Here Today, Gone Tomorrow: 'Nature’s ephemeral beauty reminds us of our own finite existence'

By Laura Parker

-

BMW X7 M60i: A car that can somehow do absolutely everything

By James Fisher

-

Kermit the frog, a silver-horned goat and Charles III’s 69ft-long coronation record star in a groundbreaking exhibition

By Carla Passino

-

Urban beekeeping — from the illegal rooftop hives in New York City to Chelsea Flower Show

By Rosie Paterson

-

A modern masterpiece for sale in Cornwall that's just one mile from the beach

By James Fisher

-

'All the floral world wants to do is procreate': Why pollen is nothing to sneeze at

By Ian Morton

-

Sign up for the Country Life Newsletter

Exquisite houses, the beauty of Nature, and how to get the most from your life, straight to your inbox.

PEOPLE & PLACES

-

-

Chanel takes a cruise around Lake Como

-

Graham Norton's elegant East London home hits the market, and it's just as wonderful as you would expect

-

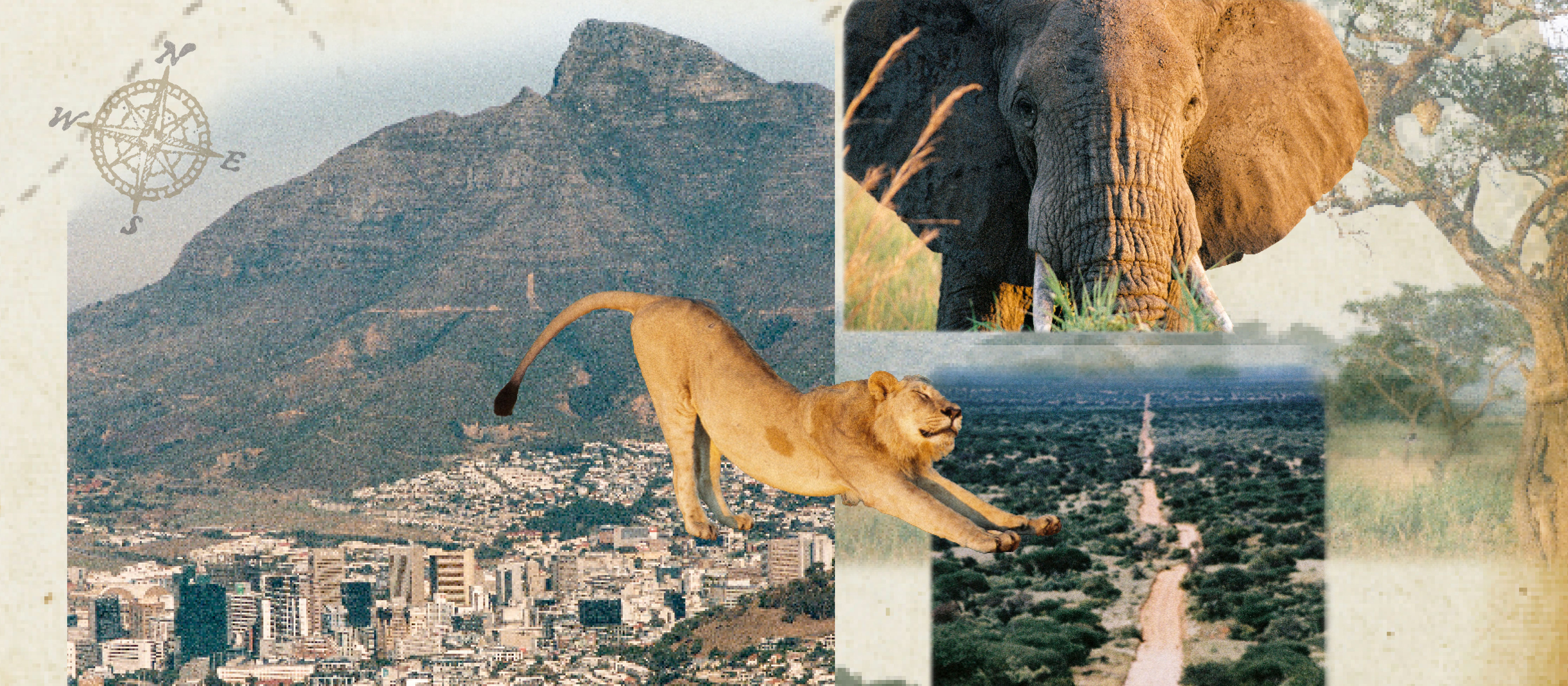

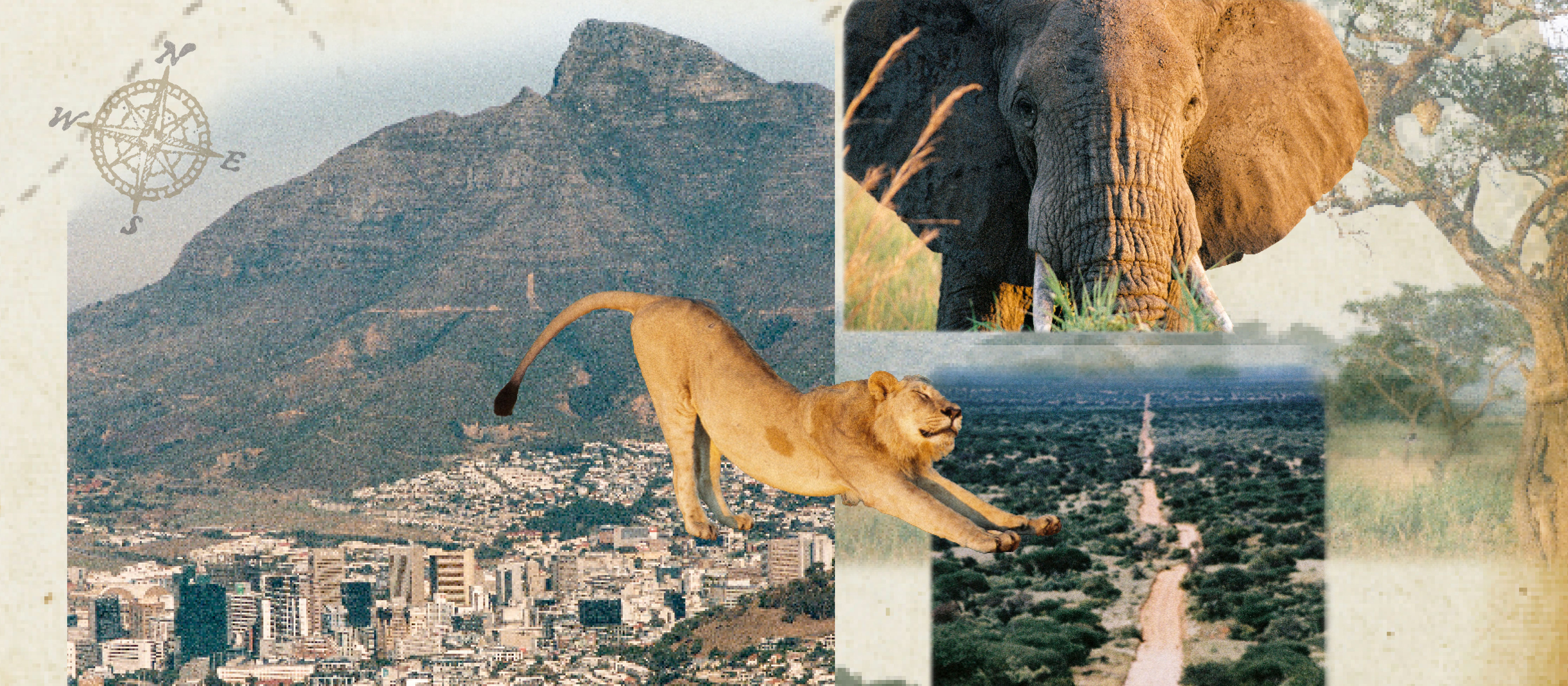

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to Cairo

-

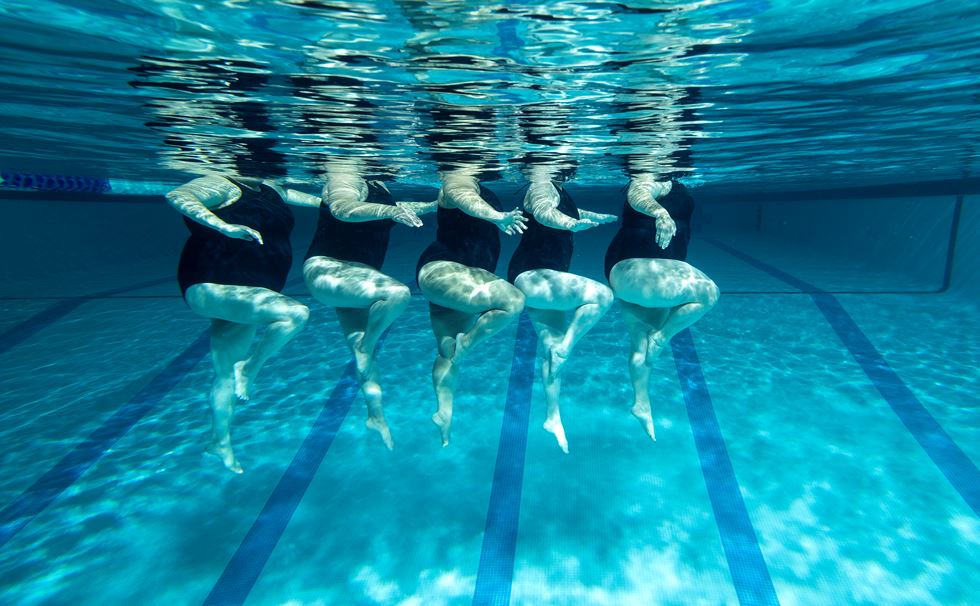

Splash! A Century of Swimming and Style: A whistle-stop history, from the Roman Baths to Hampstead Heath

-

Property

View all Property-

Five Cotswold dream homes on the market from £3m to £18m, as seen in Country Life

By Toby Keel

-

-

A modern masterpiece for sale in Cornwall that's just one mile from the beach

By James Fisher

-

A rollercoaster, Bauhaus department store and Brutalist football stand top the latest Buildings at Risk List

By Jack Watkins

-

Lutyens's last masterpiece comes up for sale in Oxfordshire, with 27 bedrooms and a cricket pitch

By James Fisher

-

A 10-bedroom manor house in the heart of the Cotswolds with all the trimmings

By Penny Churchill

-

A seven bedroom Buckinghamshire rectory that might be a little haunted

By James Fisher

-

Over the Hills and Far Away: Robert Plant's Welsh hideaway is up for sale

By James Fisher

-

Our expert voices

Interiors

View All Interiors-

18 inspiring ideas to help you make the most of meals in the garden this summer

By Amelia Thorpe

-

-

The designer's room: How rare, 19th-century wallpaper was repurposed inside a Grade I-listed apartment complex on London's Piccadilly

By Arabella Youens

-

‘It had the air of an ex-rental, and that’s putting it politely’: How an antique dealer transformed a run-down Georgian house in Chatham Dockyards

By Arabella Youens

-

The big reveal: A first look at Country Life's RHS Chelsea Flower Show stand

By Country Life

-

Sanderson's new collection is inspired by The King's pride and joy — his Gloucestershire garden

By Arabella Youens

-

Designer's Room: A solid oak French kitchen that's been cleverly engineered to last

By Amelia Thorpe

-

John Sutcliffe — The man, the myth and the paint-naming legend behind Dead Salmon and Elephant's Breath

By Carla Passino

-

The power of the youthful gaze: A new generation tackles modern day design conundrums

By Arabella Youens

-

LIFE & STYLE

View All LIFE & STYLE-

-

The last ‘private’ photograph of F1 driver Ayrton Senna taken before his death goes on display in London

By Rosie Paterson

-

Lotus Emira Turbo SE: If you want to experience the last 'real' Lotus, now is the time

By Simon De Burton

-

The chronograph watch: 'You can use it to time a furlong, a boat race, a lap of a Grand Prix or, for that matter, an egg'

By Nick Foulkes

-

Chanel takes a cruise around Lake Como

By Will Hosie

-

COUNTRYSIDE

View All THE COUNTRYSIDE-

-

Here Today, Gone Tomorrow: 'Nature’s ephemeral beauty reminds us of our own finite existence'

By Laura Parker

-

'All the floral world wants to do is procreate': Why pollen is nothing to sneeze at

By Ian Morton

-

Polluting water executives now face up to two years in prison, but will the new laws make much of a difference?

By Lotte Brundle

-

Gardens

View All Gardens-

10 outstanding British gardens from the Country Life Archive

By Melanie Bryan

-

-

A new rose named after The Princess of Wales highlights our near-universal obsession with the flower

By Amy de la Haye

-

Chelsea Flower Show 2025: The essential guide for first timers

By Tabi Jackson Gee

-

Chelsea Flower Show 2025: The first garden designed by a dog

By Annunciata Elwes

-

Testing times: Inside the RHS's Trials Garden at RHS Wisley

By Charles Quest-Ritson

-

Alan Titchmarsh: 'It’s all too easy to become swamped by the ‘to-do’ list, but give yourself a little time to savour the moment'

By Alan Titchmarsh

-

ART & CULTURE

View all ART & CULTURE-

-

Kermit the frog, a silver-horned goat and Charles III’s 69ft-long coronation record star in a groundbreaking exhibition

By Carla Passino

-

The National Gallery rehang: 'It is a remarkable feat to hang more with the feeling of less', but the male gaze is still dominant

By James Elwes

-

'Tate Modern has exploded the canon of art history, and transformed the public’s relationship with contemporary art'

By Annunciata Elwes

-

Athena: We need to get serious about saving our museums

By Country Life

-

Travel

View All Travel-

The world is your oyster and here is the pearl: How to spend £100,000 on a holiday

By Richard MacKichan

-

-

Vertigo at Victoria Falls, a sunset surrounded by lions and swimming in the Nile: A journey from Cape Town to Cairo

By Christopher Wallace

-

Everything you need to know about private jet travel and 10 rules to fly by

By Simon Mills

-

The Business Class product that spawned a generation of knock-offs: What it’s like to fly in Qatar Airways’ Qsuite cabin

By Rosie Paterson

-

Seven of the UK’s best Arts and Crafts buildings — and you can stay in all of them

By Ben West

-

Why British designers dream up the most desirable hotels

By Giles Kime

-

Food & Drink

View All Food & Drink-

Bye bye hamper, hello hot sauce: Fortnum & Mason return to their roots with a new collection of ingredients and cookware

By Lotte Brundle

-

-

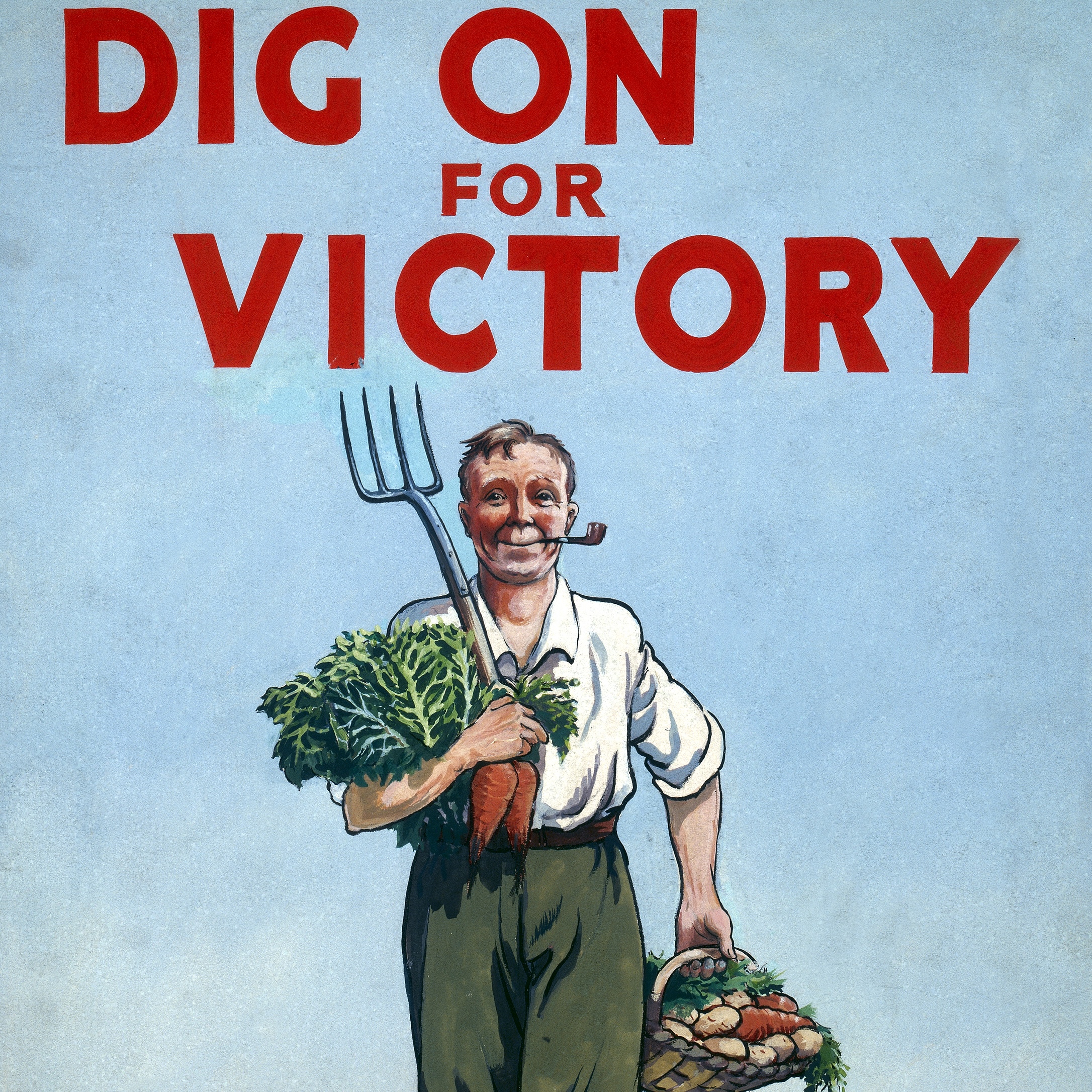

Six authentic wartime recipes to celebrate VE Day, from Lord Woolton's pie to 'Surprise Potato Balls'

By Toby Keel

-

What to bake this weekend: Xanthe Ross's chocolate chip and almond butter cookies

By Xanthe Ross

-

'Monolithic, multi-layered and quite, quite magnificent. This was love at first bite': Tom Parker Bowles on his lifelong love affair with lasagne

By Tom Parker Bowles

-

Spam: The tinned meaty treat that brought a taste of the ‘hot-dog life of Hollywood’ to war-weary Britain

By Mary Greene

-

Never leave a bun behind: What to do with leftover hot cross buns

By Amie Elizabeth White

-

Two quick and easy seasonal asparagus recipes to try this Easter Weekend

By Melanie Johnson

-